Development and Education Foundation

Patron: The Lord Maurice Glasman of Stoke Newington and of Stamford Hill

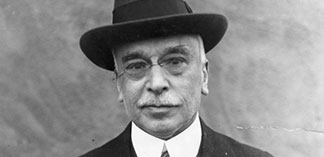

Edward Filene Biography

Credit unions should be much more than a provider of savings and loans facilities, but to work to better entire communities without division”

This very simple ideal is practiced by far too few credit unions and those organisations that institute them. The Edward Filene Credit Union Awards for Excellence, named in his memory, are the embodiment of that ideal.

Born in Boston, Massachusetts in 1898 to Jewish immigrant parents, unable to attend Harvard University because of his father’s ailing health, at the age of 19 with his brother, he took on the running of the family’s Boston clothing business. Through his own study and application of good employee relations - profit share, a minimum wage for women, a 40 hour working week, health clinics, paid holidays, a company union engaged in collective bargaining and arbitration with the proprietors – a “savings and loans” association, later the Filene Employees Credit Union, was initiated.

He was an avid promoter of his “modern” management ideas and corresponded avidly with a wide range of political leaders – President Wilson, George Clemenceau, Ramsay MacDonald, Vladimir Lenin and Mahatma Gandi.

In 1907 as a co-proprietor of “Filene’s” he went on a buying trip to India where the Colonial Government had developed rural co-operative banks funded by the British Government; simultaneously, the US Government was developing similar rural schemes in the Philippines. On his return, he reported his findings to another associate of his, Franklin Roosevelt.

From 1908 and for the rest of his life, he attended meetings throughout the USA concerning the setting up of “credit associations” free of bank control and in 1936 stated “What is needed is that the American masses shall learn the art of constructive self government (reliance) in this machine age, in this age in which life is no longer organised on a small community pattern but in which Americans are interested in what other Americans are doing” – the co-operative ideal.

Filene had many physical and social drawbacks and so required a creditable spokesperson to assist in the delivery of his ideal and though joint work in other civil organisations in Boston met Roy Bergegren and together they set up the Credit Union National Expansion Bureau, with Filene providing over $1 million to fund it over a 14 year period.

Over this period, credit union legislation was passed in 26 States, improved in another five and in 1934 the first Roosevelt Administration passed the Federal Credit Union Act that amongst many things gave credit unions as “non external profit” organisations with limited owner-memberships (non universal access) certain tax breaks that exist to this day (much to the chagrin of the banks).

In 1934 in the Depression, Filene favoured asking for $100 million dollars in State aid to develop credit unions. Bergegren stated “that accepting such aid would be destroying the principle of the whole of the credit union movement by converting a community enterprise into an agency of the Government. To teach people how to help themselves was more important by far in times of Depression than at any other time.”

In 1935, the advocacy work of the National Extension Bureau being completed the Credit Union National Association was formed, a federation funded by credit unions.

A life assurance company was formed for the credit union movement in the US, so that the outstanding debt of an owner-member on death was paid off by policy proceeds, using a $10 thousand loan provided by Filene. There does not appear to be any record of it being repaid to him.

To date the credit union movement in the USA with approximately 100 million owner-members and one of the highest levels of market penetration across the entire populace (proportionate to its size) anywhere in the world. 46.20% penetration. Ireland has 75%!

Filene never held office in a credit union or associational body but a major consequence, unknown to him during his lifetime and through the resultant actions of others, was the spread of the mutually owned co-operatively run credit union movement worldwide.

On his death in 1937, President Franklin Delano Roosevelt gave a eulogy to an extraordinary US citizen, the content of which is even more relevant today:- “He was a prophet who perceived the true meaning of the changing times. He was an analyst, who was able by mathematical calculations, to make it plain to us that our modern mechanism of abundance cannot be kept in operation unless the masses of our people are enabled to live abundantly. He believed in searching out the way of human progress”.

Filene’s indomitable spirit and driving will for the success of all types of credit unions and to inspire all their leaders to performance heights is summarised in his most famous remark:- "Do the best you can today and tomorrow do it better"